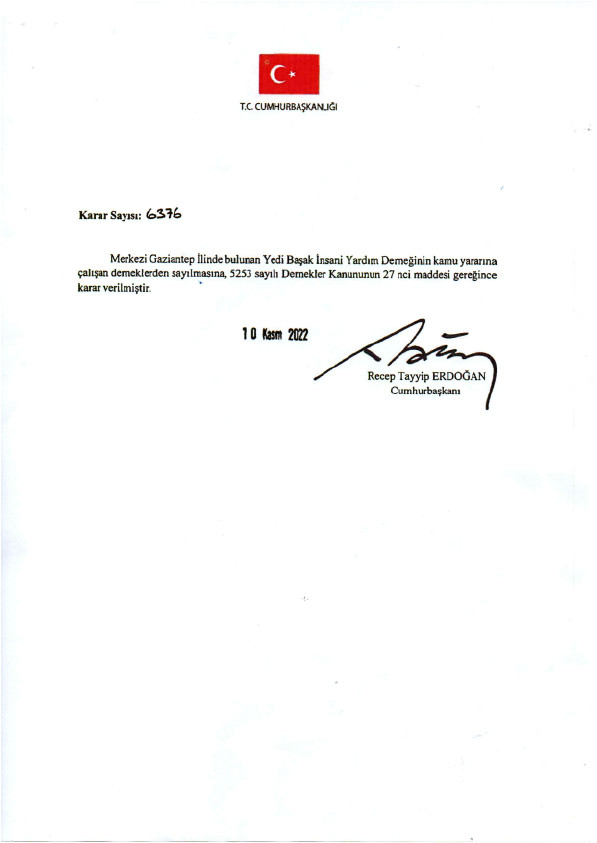

PUBLIC BENEFIT STATUS

Our association has the status of an association working for the public body in accordance with the Presidential decision and article 27 of the Law on Associations No. 5253.

Donations and aids made by associations serving public institutions, income and corporate tax achieve their ultimate purpose in determining the tax base of their income, within the conditions specified in Article 89 of the Income Tax Law and Article 10 of the Corporate Tax Law, and organs.

According to Article 10 of the Corporate Tax Law;

c) The total of donations and aids made by the Council of Ministers to public administrations with general and special budgets, special provincial administrations, municipalities and villages, foundations applying tax exemption, and associations and institutions operating in public enterprises. and scientific research and development organizations, up to 5% of this. It can be deducted from the income and corporate income to be declared with the annual declaration according to the Corporate Tax Law fees.

According to article 89 of the Income Tax Law; 4. Not to exceed 5% (10% for pre-zoning regions) of the annual total income to be declared to public administrations with general and special budgets, special provincial administrations, municipalities, villages and associations and foundations affiliated to public institutions. Donations made through donations and donation providers that are tax exempted by the Council of Ministers. It can be deducted from the income to be declared with the annual declaration according to the Income Tax Law fees.

Donations made to associations affiliated with public institutions through receipt servers can be deducted from the income and corporate earnings to be declared with an annual declaration according to the fees in the Income and Corporate Tax Laws.

In this framework, donations and aids made by taxpayers to associations working in public institutions are regulated in Article 89 of the Income Tax Law and Article 10 of the Income Tax Law in the Corporate Tax Law.